BBMP has transformed its property management system and created an online portal called the E-Aasthi portal that allows residents of Bengaluru to access property records and verify them online. The purpose of the BBMP E-Aasthi project is to eliminate paperwork, reduce corruption, and enhance transparency in property-related services.

Using this system, property owners can access important documents such as Khata, Property Identification Number (PID), and Mutation Register Copy (MRC) directly from the official website.

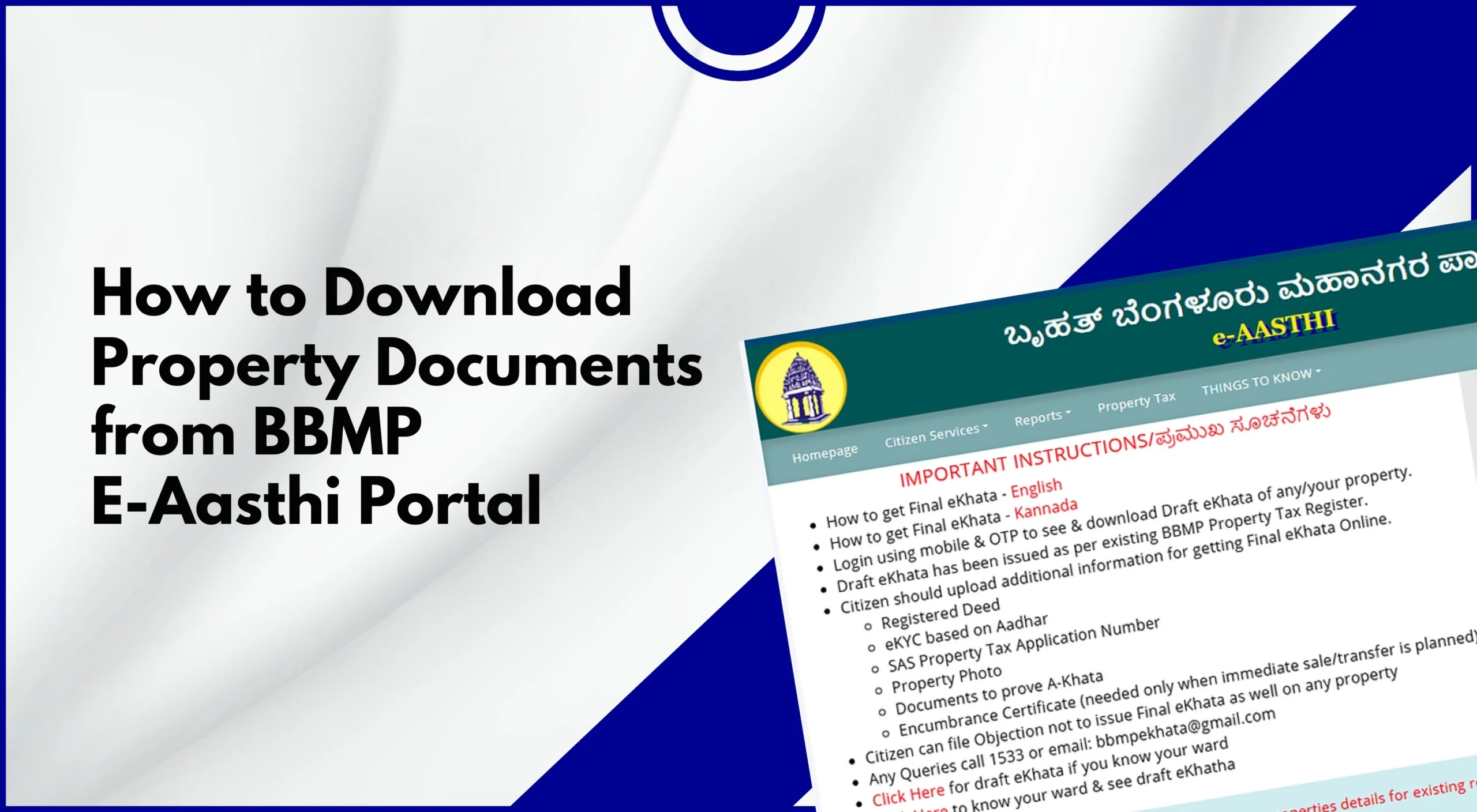

This guide explains how to complete the BBMP E-Aasthi download process, understand different property documents, and verify ownership records correctly.

What Is the BBMP E-Aasthi Portal?

The E-Aasthi portal is BBMP’s online property record management system designed to computerize and store ownership, assessment, and transaction details of properties within Bengaluru city limits.

E-Aasthi, meaning electronic property record, is a Karnataka Government e-Governance initiative aimed at improving transparency and accessibility of urban property records.

The portal integrates property tax details, Khata information, and GIS mapping into a single database. This ensures property ownership and transaction details remain updated and verifiable in real time. Through E-Aasthi online, users can:

- Verify ownership of registered properties under BBMP

- Check property tax payment details using PID

- Download Khata extracts, PID information, and Mutation Register Copies (MRC)

- Ensure property data matches government tax and registration records

Key Property Documents Available on BBMP E-Aasthi

Before proceeding with the E-Aasthi download, it is important to understand the key property documents available on the portal.

1. Property Identification Number (PID)

Each property under BBMP jurisdiction is assigned a unique Property Identification Number (PID). This number is used as the primary reference for property tax payments, ownership verification, and official transactions.

2. Khata Certificate

The Khata is an official property ownership record maintained by BBMP. It includes details such as owner name, property size, location, and tax assessment.

A Khata certificate is required for property sale, building approval, and utility connections. With E-Aasthi online, property owners can download their Khata certificates without visiting BBMP offices.

3. Mutation Register Copy (MRC)

The Mutation Register Copy records changes in property ownership due to sale, inheritance, or transfer. It confirms that ownership changes are legally recorded in municipal records.

Using the BBMP E-Aasthi portal, owners can download the MRC digitally, ensuring transparency and legal compliance.

Also Read: Different Types of Khata in Bangalore: Complete GuideHow to Download Property Documents from BBMP E-Aasthi

The BBMP E-Aasthi download process is simple and can be completed in a few minutes if the correct property details are available.Step 1: Visit the Official BBMP Website

Go to https://bbmp.gov.in/. Navigate to the “e-Services” section and click on “E-Aasthi”.

Step 2: Search for Your Property

You can search using:

- Property Identification Number (PID)

- Owner’s Name

- Property Address

If you do not know your PID, refer to your latest BBMP property tax receipt.

Step 3: View Property Details

The system will display ownership details, ward number, property dimensions, and tax assessment information. Verify these details carefully.

Step 4: Download Required Documents

- Khata Certificate or Extract

- Mutation Register Copy (MRC)

- Property Tax Payment History

Step 5: Save or Print

Save or print the digitally authenticated document for official or legal use.

How to Access BBMP E-Aasthi Online Services

- Visit https://eaasthi.karnataka.gov.in/

- Select the appropriate Bengaluru zone

- Enter PID or property address

- Verify displayed property details

- Download or print documents as required

Verifying Property Ownership Using E-Aasthi

The E-Aasthi system allows instant verification of property ownership, which is especially useful for buyers, legal professionals, and property owners.

- Enter the PID on the E-Aasthi portal

- Check ownership and Khata type

- Confirm property tax payment status

- Match details with physical documents

Common E-Aasthi Errors and Solutions

| Problem | Possible Cause | Solution |

|---|---|---|

| Property not found | Incorrect PID | Verify PID from tax receipt |

| Download not working | Browser issue | Use updated Chrome or Edge |

| Missing documents | Data not migrated | Contact BBMP Revenue Office |

| Incorrect ownership details | Outdated records | Apply for correction at BBMP office |

Benefits of Using BBMP E-Aasthi

- Transparency: Verified government property records

- Efficiency: No physical visits or agents required

- Accuracy: Data synced with BBMP tax records

- Security: Reduced fraud and third-party involvement

- Accessibility: Available 24/7

Contact and Support Information

- BBMP Helpline: 1533

- E-Khata Helpline: 9480683695

- Email: comm@bbmp.gov.in

- Address: Hudson Circle, N.R. Square, Bengaluru – 560002

Also Read: Seva Sindhu Karnataka: Registration, Login & Services

Conclusion

The BBMP E-Aasthi portal simplifies property management in Bengaluru by providing easy access to Khata, PID, and MRC documents. It ensures transparency, accuracy, and convenience for property owners and buyers. Always use the official BBMP E-Aasthi portal for reliable and up-to-date property records.

Frequently Asked Questions

I downloaded the Khata certificate from the E-Aasthi portal. Is it valid legally?

Yes, the document downloaded from the E-Aasthi portal is legally valid. You can use your Khata certificate for your official purposes like bank loans, property registration, and application for utility connection.

What should I do if the ownership details displayed on the E-Aasthi website are incorrect?

If you find any discrepancy, then you should file a correction request to the BBMP revenue department. You have to physically submit your document and request to update the correct ownership details on the document.

Can I pay my property tax through the E-Aasthi portal?

No, you cannot pay your property tax through the E-Aasthi portal. The primary function of this portal is to view or download your property records. For tax payment, you should visit the dedicated BBMP property tax portal.

Leave A Comment